This is an abreviated article that you'll receive weekly just for joining. I love this. These articles are well written and so valuable for anyone who wants to get ahead financially. To see the entire article, click on the image below to go to the site and join.

Here's the article:

Markets closed the week higher on the back of mixed news about

the economy and banking industry.

Silicon Valley Bank continued to dominate headlines last week. If you

missed what happened, below is a quick refresher, of what’s going on

and how to protect your money. Stay tuned — we’ll keep you updated

on the news that impacts you.

Let’s take a closer look at the economy and what to expect next.

REFRESHER:

Last Wednesday, Silicon Valley Bank announced they had lost money

on those bonds and that they needed to raise money to be able to

backstop customer deposits.

Worried about the bank’s health, more and more customers began to

withdraw their deposits, starting what is called a “bank run.” By Thursday,

the bank had almost $42 billion in withdrawal requests — more than it

could meet. To stem the concerns about widespread losses, the FDIC

stepped in and took control of Silicon Valley Bank.

Headlines about bank runs can ... join now to read the full article. |

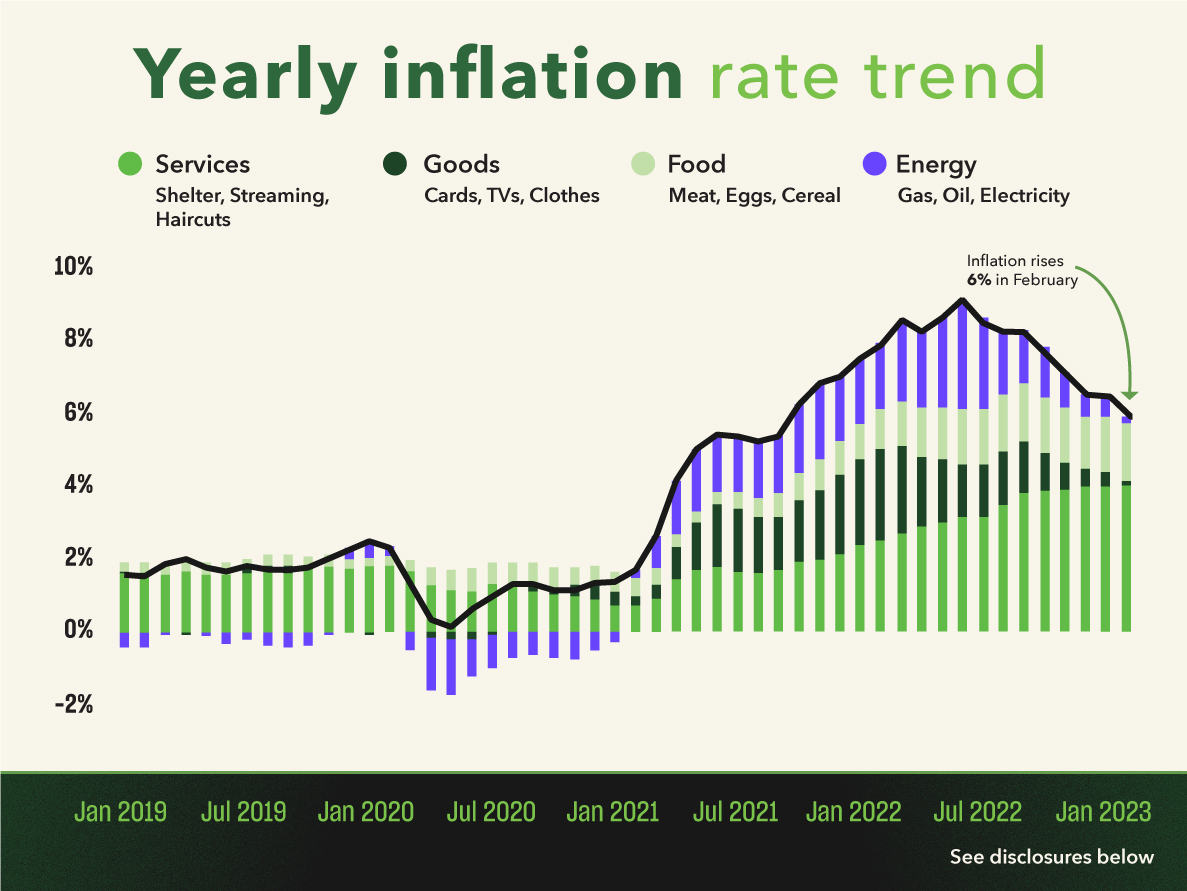

The Fed meets over the next two days to decide whether or not to

increase interest rates again. Their decision will ultimately come down

to the latest data — and the latest data shows inflation has gotten better.

- The inflation rate fell to 6% in February thanks to moderate price increases for the big food, energy, and goods categories. It's been a months-long journey to get to this point,... join to read more.

Overall, February’s inflation rate marked eight straight months of steady

declines and the lowest reading since September 2021. |

What’s next? After the recent events with Silicon Valley Bank as

well as the positive developments with inflation, it’s now possible

the Fed will actually be cutting interest rates by the end of the year.

This would be a major U-turn for investors, who expected rates to

keep rising through 2023.

|

| Take home more of your profits |

|

Don’t forget: the tax deadline is fast approaching. Maximizing your tax

benefits doesn’t happen overnight, but it’s something you can

start working towards today.

Remember: Waiting for at least a year before you sell your investments

means you may pay less tax on them. Long-term capital gains, or profits

from selling an investment over a year after buying it are normally taxed

at a flat rate of 0%, 15%, or 20%, depending on your taxable income.

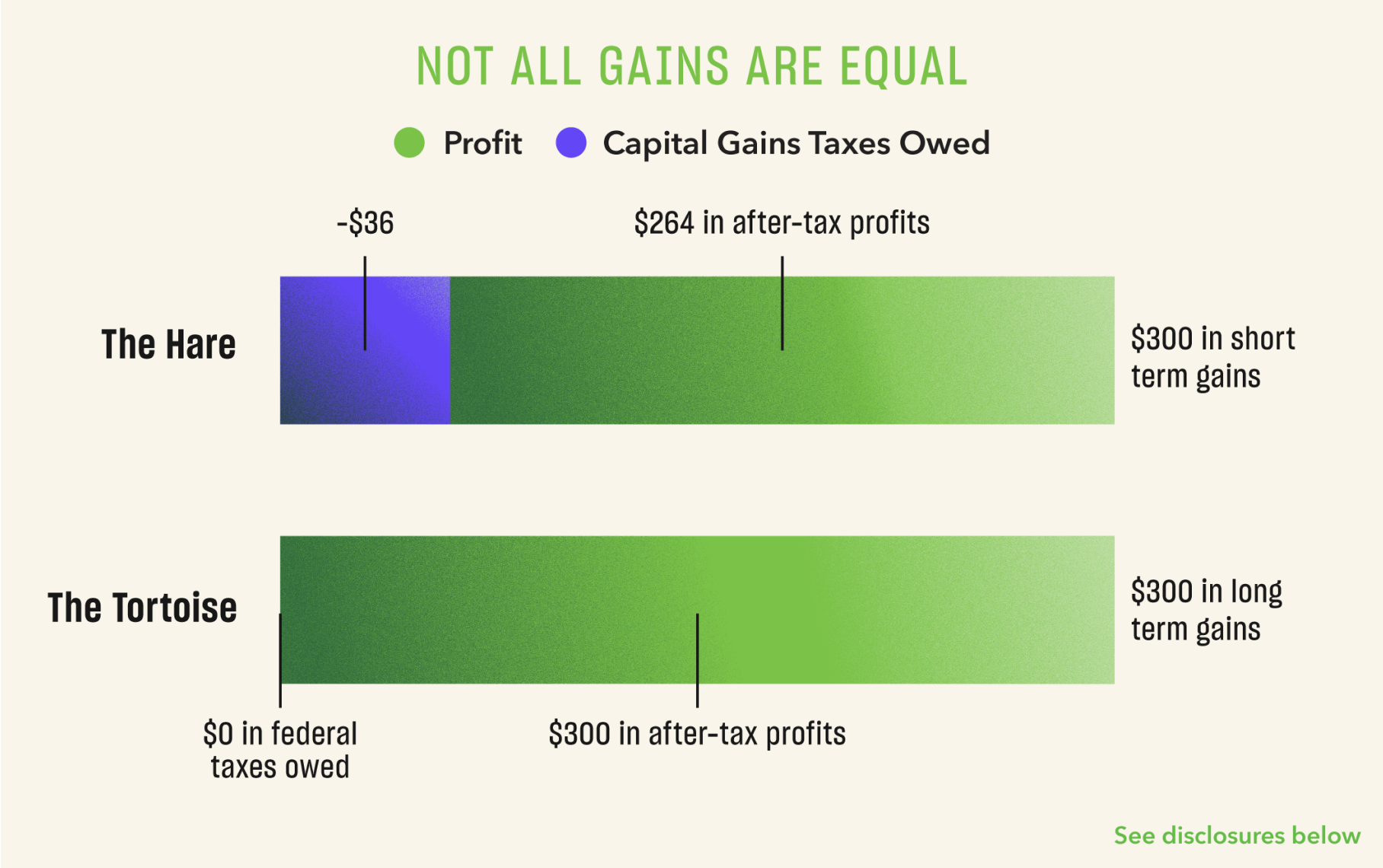

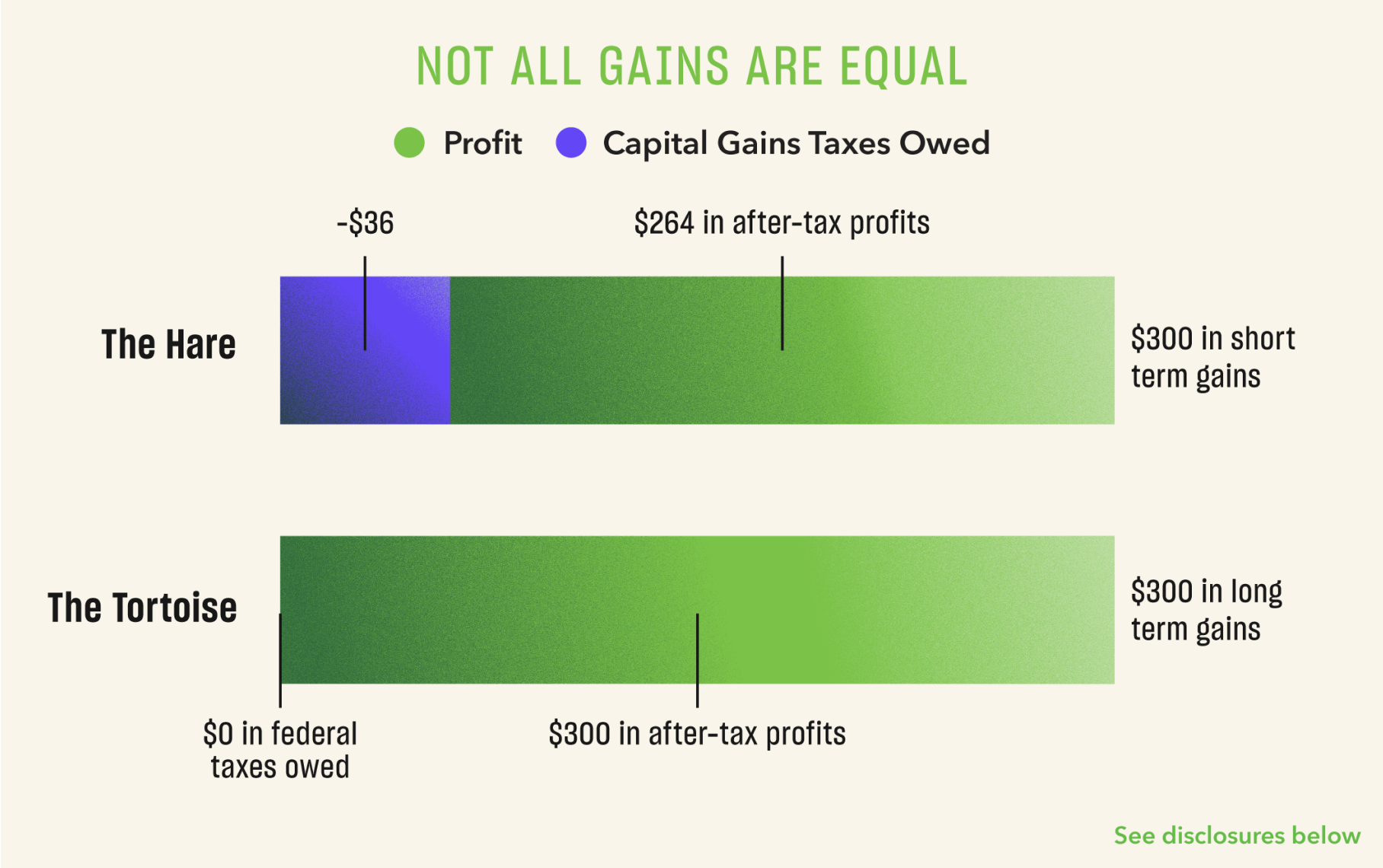

Let’s take a look at that in practice. Here are two hypothetical investors

earning an income of $55,000 a year (each file as the head of the

household in tax year 2022):- Investor A invests $1,200 on the first of the year, and sells the same investment three months later for $1,500 — a $300 profit.

- Investor B invests $1,200 on the first of the year, and sells the same investment 13 months later for $1,500 — also making a $300 profit.

After paying capital gains taxes, which investor takes home more

money?

Investor B! Even though both investors seemingly profited the same

amount from their investments, Investor B was taxed at the lower

long-term capital gains tax rate, because they held their investment

for over a year.

Since both investors make $55,000 a year, Investor A owed 12% in

short-term capital gains taxes and Investor B owed 0% in long-term

capitals taxes.

Of course, state, local and income taxes may still apply. And how you’ll

be taxed on your long-term capital gains will vary based on your income

and tax bracket, so don’t expect it to necessarily be 0%. You can learn

more about your federal income tax bracket here.

|

|

The takeaway: Holding on to your investments for a year (or more!)

means you may pay a lower long-term capital gains tax rate. In other

words, when you account for taxes, it’s clear that not all gains are

created equal.

|

In many cases, it can be better to earn long-term capital gains with lower

tax rates than it is to sell within a year and owe the short-term capital

gains taxes.

Was this week’s newsletter helpful? Let us know what you think!

|

Get started with Acorns Invest and we'll recommend a diversified portfolio

for you. |

|

Market commentary provided by Seth Wunder (Chief Investment Officer)

Contributors to this week’s newsletter: Casey Hollis (Managing Editor), Trevir Nath

(Senior Writer), Caelon Smith (Investment Data Analyst), Emily Gadd (Associate Editor),

and Adam Grason (Senior Brand Designer). |

|

|

|

No comments:

Post a Comment